TVS bullish on electric mobility; EVs expected to capture 30% of scooter market and around 35% of three-wheeler segment by 2025

With huge unlocked potential in electric two-wheeler and three-wheeler segments, TVS has been making huge investments in this space. After last year’s investment of Rs 1,000 crore, TVS Motor has announced another 1,000 crore investment this year. Most of the funds will be utilized for capacity expansion and development of new EV products.

TVS senses a big opportunity in EV space, as there’s no clear winner at this point of time. It’s a constant battle, as dozens of EV companies have forayed into EV space. TVS has potential to become one of the top EV companies, as it has technical capabilities, abundant resources and the advantages that come with a pan-India dealer network. TVS is currently in top 10, but trails behind Okinawa, Hero Electric, Ola Electric, Ampere and Ather.

25k monthly production by 2022 – 50k by 2023

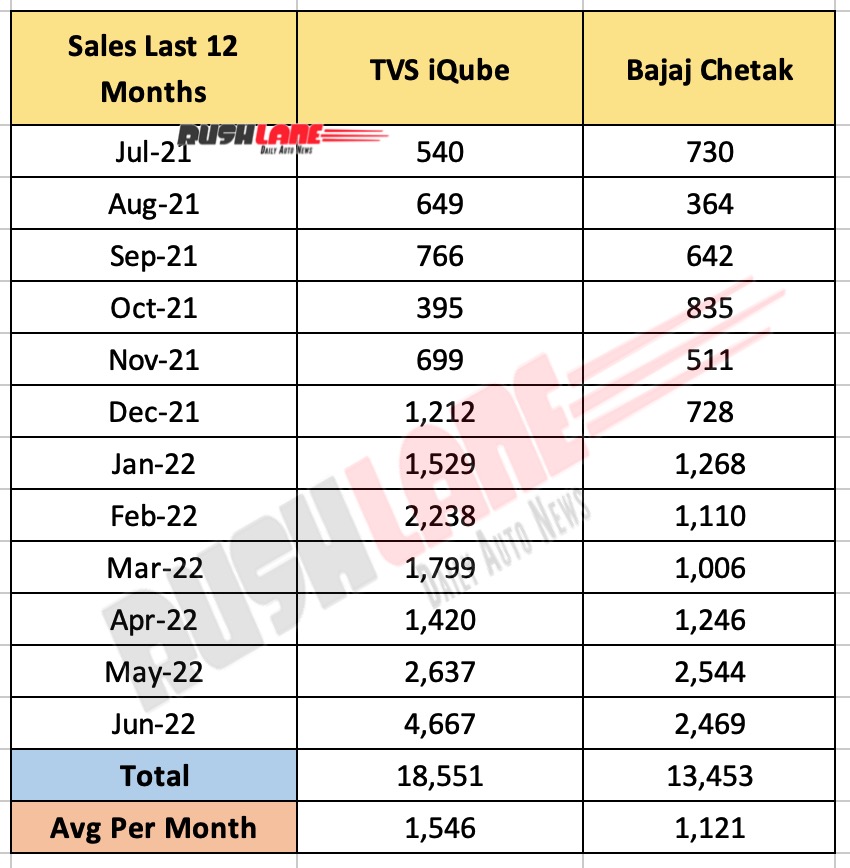

TVS recently launched upgraded iQube that has received significant number of bookings. TVS Motor MD Sudarshan Venu has said that they will be launching another new EV later this year. In June 2022, iQube posted its highest ever monthly sales till date, recording 4,667 units. Last 12 month avg sales of iQube has increased to 1,546 units while that of Bajaj Chetak for the same period is 1,121 units.

With fresh investments, TVS aims to increase iQube electric scooter production to 25k units per month by the end of this year. This will be more than twice the existing production capacity figures. By 2023, TVS will aim to increase production capacity by 100%, making it 50k units per month. This will entail production capacity of around 5-6 lakh units per year.

A significant percentage of the investments made by TVS have been routed through its overseas subsidiaries. For example, around Rs 1,100 crore have been channelled through TVS Singapore. These funds have been invested in other subsidiaries such as Swiss e-Mobility Group (SEMG) that received around Rs 750 crore. TVS had acquired SEMG earlier this year with a 75% stake in the company.

Another trench of funds of Rs 130 crore was allocated for EGO Corporation. This Swiss-based e-bike company was acquired by TVS last year in an all-cash deal. Remaining funds were transferred to Norton Motorcycle. Till date, TVS Motor’s total investments routed through TVS Singapore were at Rs 1,892 crore in FY22. In the year ago period, the numbers were at Rs 809 crore.

In addition to investment in its subsidiaries, TVS also allocated funds worth Rs 730 crore for capital expenditure in FY22. As compared to last year’s figures, YoY growth is 31%. The total of investments and capital expenditure by TVS in FY22 works out at around Rs 2,100 crore. Due to these massive investments, TVS free cash flow had turned negative. This was despite improved operating performance, powered by higher sales and cost reduction. This shows that the company is bullish on EV space and has made aggressive plans to establish a strong presence.

Focus on ICE segment too

While TVS has been making massive investments in EV space, it is not being done at the expense of its mainstream internal combustion engine (ICE) portfolio. TVS is working to revamp its ICE portfolio with entry into new segments. TVS is currently popular for its affordable commuter bikes and performance-oriented Apache range. The company is planning to introduce new premium lifestyle products, like new Ronin. The company is hopeful that market sentiments will remain favourable, which will help achieve desired growth in both ICE and electric mobility segments.